Discover how India’s new “Next-Gen GST Reform” simplifies the tax structure and reduces prices on essentials like soap, groceries, and electronics while increasing taxes on luxury and sin goods like tobacco and aerated drinks. Learn which items are cheaper, which are costlier, and how it impacts everyday families.

A Diwali Gift for Every Indian

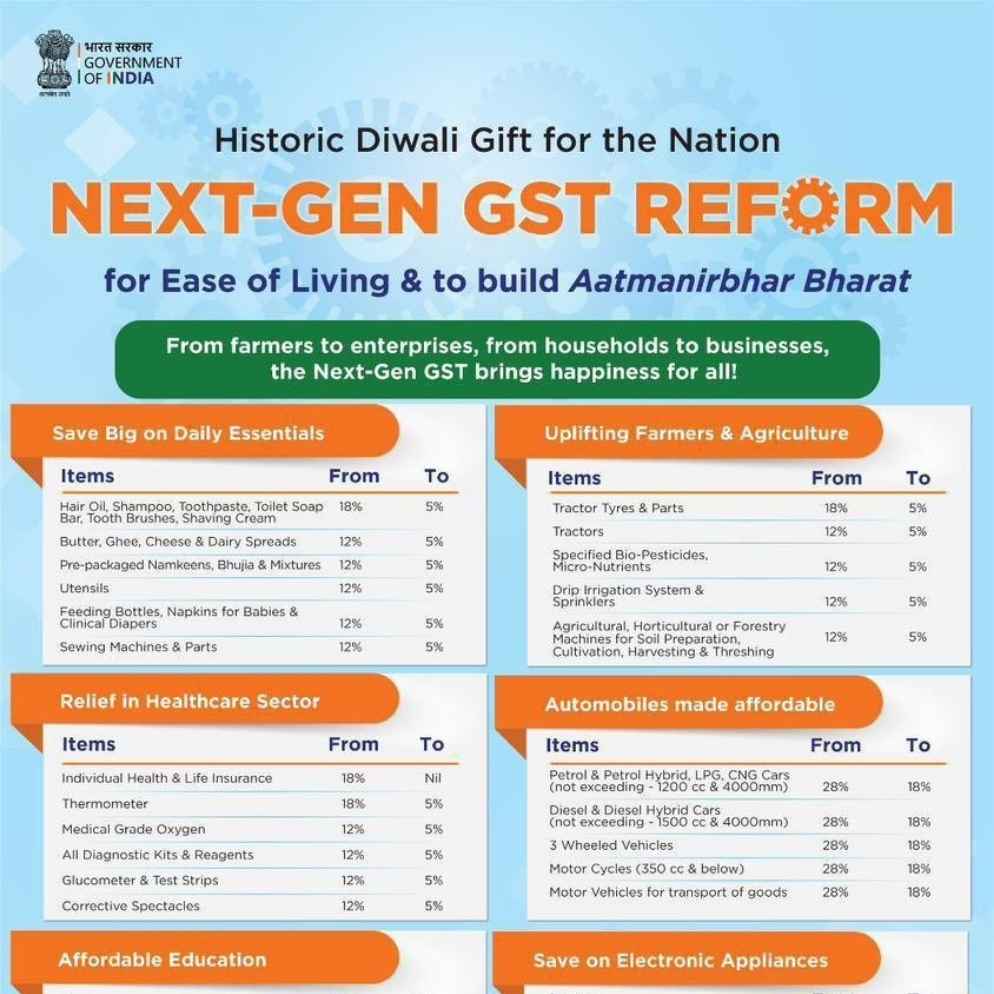

This Diwali, the Indian government has unveiled sweeping changes to the Goods and Services Tax (GST) system-calling it Next-Gen GST Reform. It’s a major move to simplify tax slabs, reduce prices for everyday items, and enable a smoother economy. Starting September 22, 2025, GST rates collapse into two main slabs: 5% for essentials and 18% for standard goods, with a new 40% tax on luxury and “sin” goods. What’s Getting Cheaper? Essentials Now at 5% or Nil

Many essential items are now more affordable, taxed at just 5% or even 0%:

Daily Care Goods – GST slashed from 18% to 5%

Hair oil, shampoo, toothpaste, soap, toothbrushes, shaving cream

Butter, ghee, cheese, dairy spreads; packaged namkeens, bhujiya, mixtures

Utensils, sewing machines & parts; feeding bottles, napkins, diapers

Reduced to 5% or 0%

Paneer (pre-packaged), UHT milk (to 0%), Indian bread, sauces, pasta, noodles, cornflakes, chocolates, jam, jellies, pastes, dates, figs, nuts, and dried fruits

Education & Healthcare Essentials – Tax cut or exemption

Maps, charts, globes, crayons, notebooks, exercise books, erasers → 100% tax-free

Life & health insurance → Nil GST

Diagnostic kits, glucometer strips, medical oxygen, spectacles → cut from 12%–28% to 5% or less

Electronics & Automobiles – Reduced from 28% to 18%

Air conditioners, TVs, monitors, projectors, washing machines

Small cars, diesel & petrol hybrids under 4000cc, 3-wheeler vehicles, motorcycles under 350cc, goods vehicles

What’s Getting Costlier? Sin Goods Now 40% GST

To discourage harmful and luxury consumption, a hefty 40% GST is introduced on sin and premium goods:

Included: Aerated beverages, carbonated drinks, caffeinated drinks, luxury vehicles, helicopters, yachts

Tobacco-related items such as pan masala, gutkha, cigarettes, zarda, and beedis will remain at current rates until pending compensation cess liabilities are cleared

Next-Gen GST Reforms

Why This Matters for Every Indian

Inflation Eased: Tax cuts on essentials expected to lower consumer prices, reducing inflation by up to 0.5–0.9%

Simpler System: Consolidates four GST slabs into two (plus the 40% sin rate) – easier for consumers and businesses

Boost to Consumption: Lower taxes on daily goods and electronics are likely to drive demand during the festive season

Discouraging Harmful Goods: Higher taxes on tobacco and sodas aim to curb health risks

Effect on Households and Small Businesses

| Item Type | Old GST Rate | New GST Rate | Benefit |

|---|---|---|---|

| Soap, toothpaste | 18% | 5% | Cheaper hygiene products |

| Paneer, bread | 5% | 0% | Tax-free staples |

| ACs, TVs, small cars | 28% | 18% | Reduced the cost of electronics and vehicles |

| Tax-saving Kits | 12–18% | 5% | Health tools become affordable |

| Tobacco, aerated drinks | 28% | 40% | Tax deterrent to reduce harmful consumption |

India’s Next-Gen GST Reform is a major win for the common citizen. It brings down the cost of everyday essentials, makes education and healthcare more affordable, and simplifies the tax system. The higher tax on indulgent goods channels resources thoughtfully while nudging healthier consumer choices.

This reform is not just a GST update, it’s a Diwali blessing that brightens economic opportunities for millions.